Inequality Green Paper

calls for government policy reform to tackle economic equality gap

The deep economic divide between Australia’s rich and poor is now significantly higher than in the 1980s, and is in danger of worsening, unless wide-ranging government policy reform is undertaken.

In Not A Level Playing Field, a Green Paper commissioned by the Actuaries Institute, Taylor Fry authors Dr Hugh Miller and Dr Laura Dixie, carried out an in-depth analysis to determine the role demographic factors, such as age, gender, disability, location, education and employment backgrounds play in determining inequality, as well as the resulting flow-on effects across society.

The paper brings together, for the first time, a raft of Australian survey data with new analysis to paint a snapshot of income inequality in Australia. Importantly, it builds on the established work of the Australian Actuaries Intergenerational Equity Index, led by Taylor Fry and the investment valuation work actuaries pioneered for Federal and State governments.

The wealthiest 20% of households currently have six times the disposable income of the lowest 20%

Lead author Hugh Miller says, “Our analysis has found that where you live, your gender, age, First Nations status, ethnicity, disability, education and employment backgrounds are all drivers of income inequality in Australia. But the big disconnect between robust economic growth and tepid wages growth in our two-speed economy is what has really exacerbated the inequality gap.”

The fear is that the income gap could widen even further because of the increasing casualisation of the workforce and more people being employed by the ‘gig’ economy.

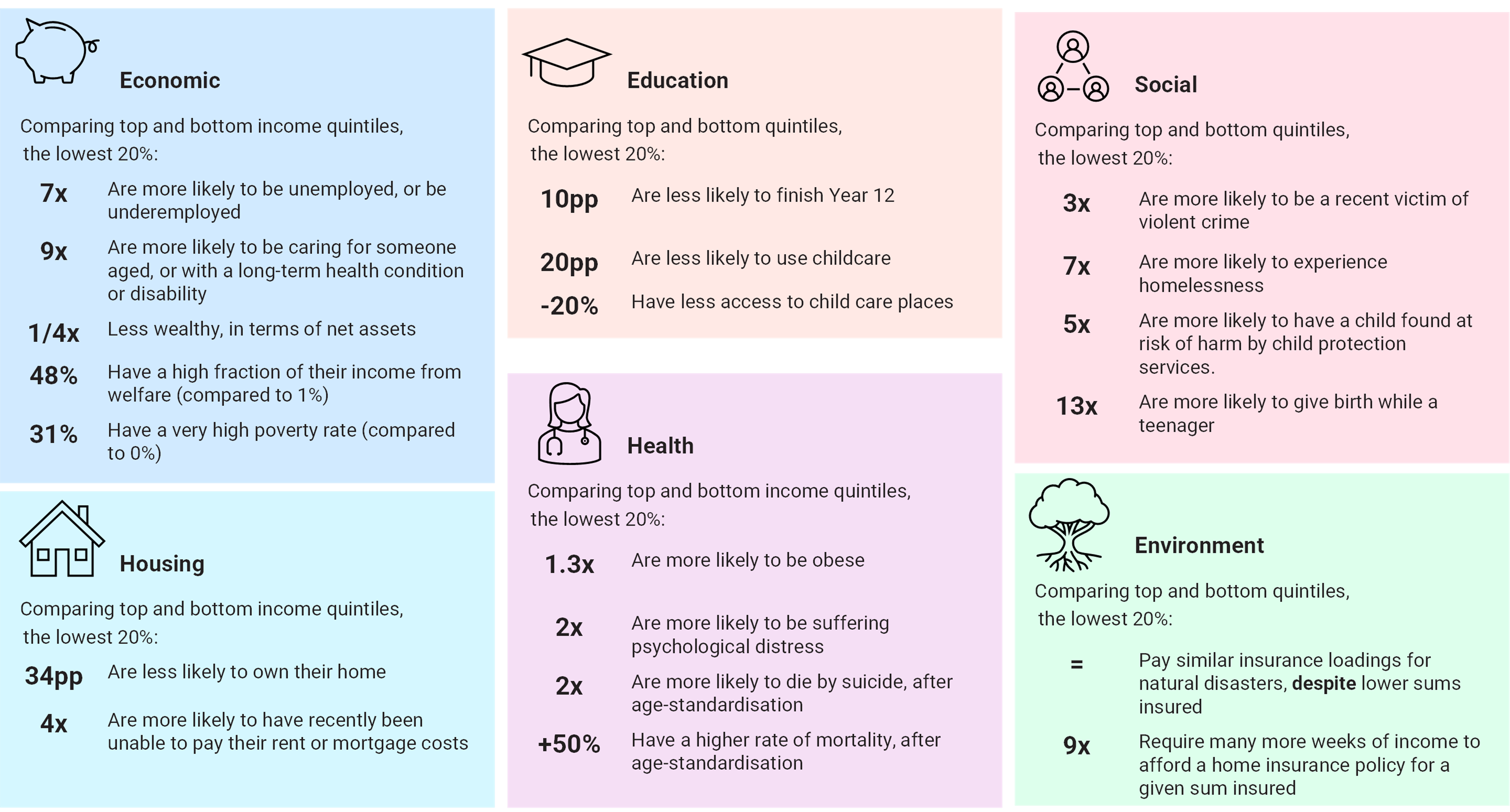

Existing economic inequalities translate into large differences in wealth and wellbeing

Eighty per cent of people in the Organisation for Economic Co-operation and Development (OECD), and 70% within Australia, feel income disparities are too large in their country. Australia’s income inequalities are midrange by international standards – many developed countries have greater inequalities, but others significantly lower.

“This (inequality) gap has a variety of impacts on everything from poverty levels to housing affordability and life expectancy, as well as your chances of being a victim of crime, being able to pay your insurance bills and enjoy a comfortable retirement,” Hugh says.

The paper highlights that inequality is significantly higher than in the 1980s, with the wealthiest 20% of households currently having six times the disposable income of the lowest 20%. Wealth inequality is even larger with the wealthiest quintile having 230 times more net assets.

These big gaps in income and wealth have translated into poorer social outcomes for low-income households. Most notably, comparing the poorest 20% of households to the richest 20%, those living in the lowest income households were:

- 9x more likely to be an unpaid carer

- 7x more likely to have experienced homelessness and unemployment

- 5x more likely to have a child at risk of harm

- 4x more likely to have recently been unable to meet rent or mortgage costs

- 3x more likely to be a recent victim of crime

- 2x as likely to suffer psychological distress or die by suicide

There were also significant gaps in home ownership, access to childcare, and Year 12 completion rates. Reliance on welfare payments was also higher for low-income households.

Differences in income correlate strongly with indicators across different factors

Considering inequality in setting policy direction

The Green Paper outlines that targeted solutions supporting improvements in equality are likely to generate even broader benefits and support significant gains in overall wellbeing.

“We believe Inequality needs to be a prominent consideration in setting policy direction,” Hugh adds. “Providing targeted assistance (financial or otherwise) to lower income households will deliver significantly more benefits than generic ‘one-size-fits-all’ assistance programs for all households.”

The paper outlines several areas for policy reform based on suggestions by the Actuaries Institute, Productivity Commission, the Australian Council for Social Service and other expert bodies and reviews. Areas for reform span continued investment in improved data collection, linkage and modelling to support effective targeted government assistance, to specific policy changes in the tax and transfer system such as increasing rental assistance, changes to the Age Pension means test and to superannuation to address equity issues in retirement.

Listen to the Actuaries Institute podcast here.

Other articles by

Hugh Miller

Other articles by Hugh Miller

More articles

NSW Department of Communities and Justice releases Taylor Fry report

Taylor Fry’s findings and recommendations in a report for the NSW Government evaluating a key initiative to improve lives

Read Article

Well, that generative AI thing got real pretty quickly

Six months ago, the world seemed to stop and take notice of generative AI. Hugh Miller sorts through the hype and fears to find clarity.

Read Article

Recent articles

Recent articles

More articles

RADAR FY2025 – Balance and meaningful action vital amid huge wins

Amid another high-profit year, RADAR FY2025 offers expert insights on the hot topics for insurers. Dive right in to find out more.

Read Article

Press release – Taylor Fry announces Canberra chief for government practice

An exciting new chapter for Taylor Fry with the launch of our office in the nation's capital and the appointment of Jeremy Smith-Roberts

Read Article