Launch of the Australian Actuaries Intergenerational Equity Index

Today the Actuaries Institute launches its Intergenerational Equity Index. Commissioned by the Institute, and developed by Taylor Fry’s Hugh Miller, Ramona Meyricke and Laura Dixie the Index and accompanying Green Paper show the gap between young and old has never been larger.

Increasingly, actuaries are contributing to important public policy debates, addressing issues such as climate change, mental health and retirement. Most recently, the Actuaries Institute is looking to explore whether we are treating different generations fairly and providing opportunity to all. Intergenerational fairness involves understanding long-term, complex issues and is well suited to the actuarial mindset.

About the Australian Actuaries Intergenerational Equity Index

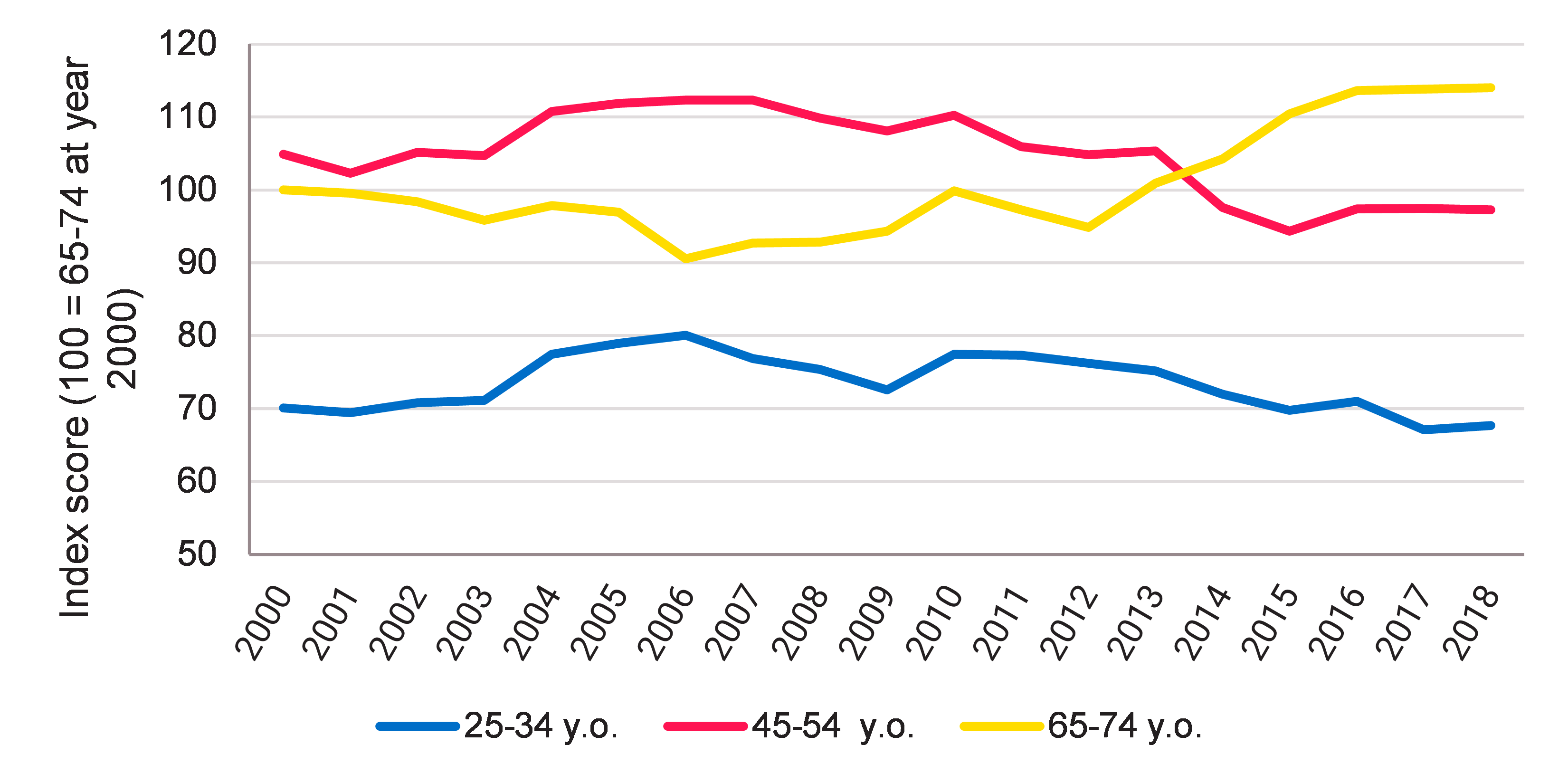

We have helped develop an Intergenerational Equity Index, and written a Green Paper Mind the gap – Australian Actuaries Intergenerational Equity Index . The Index tracks the wealth and wellbeing scores of three distinct age groups over time: 25-34 years old, 45-54 years old, and 65-74 years old.

The wealth and wellbeing scores are formed from 24 indicators across six domains (Economic & fiscal, Housing, Health & disability, Social, Education, and Environment) and combined into a single score. The score tracks whether wealth and wellbeing are getting better or worse over time. Relative movements of different age bands provide insight into how developments over time are affecting various age groups differently. A widening of gaps between age bands can represent deterioration in intergenerational equity.

The figure below shows the absolute index results.

Absolute index results

What does the Intergenerational Equity Index show?

While some gaps between age groups should be considered normal due to natural life stages (for example, older people have had more time to accumulate wealth or buy a house), the striking result from the index is that the gap between the youngest age group (25-34, currently Millennials) and the oldest (65-74, currently Baby Boomers) has never been larger. This suggests we’re experiencing growing intergenerational tensions, as exemplified by the ‘OK Boomer’ meme seen in 2019.

The paper itself is well worth a read for full details of how the index is constructed and what drives the results. The individual indicators show interesting trends even before being aggregated into the index. Here we highlight just a few items:

- Real household net wealth has grown about 90% for the 65-74 age group over the past 15 years, compared to 20% for the 25-34 age group. The gains from large increases in asset values, including housing, has advantaged older generations most.

- The proportion of 25-34-year-olds owning a home has fallen from 51% to 37% in the 17 years to 2018. This compares to a seven percentage point drop for the 45-54 age group and a one percentage point drop for the 65-74 age group. Housing affordability has worsened significantly, despite record low interest rates. It now takes longer to save for a deposit and house prices, particularly in the bigger cities, have grown far faster than incomes.

- Environmental issues, a commonly cited intergenerational issue, have dragged down the index for younger people. Larger temperature anomalies, more CO2 in the atmosphere and lower rainfall are all issues that are likely to continue to worsen.

However, it’s important to remember intergenerational issues are not solely about the problems younger Australians face. The Royal Commission into Aged Care Quality and Safety has highlighted the failure of society to allow the elderly to live with dignity in their final years. And poverty rates are high for subgroups across different ages, notably for pensioners who do not own their own home.

Why is it a good time to be talking about intergenerational equity?

The COVID-19 pandemic has brought some intergenerational issues into sharp relief. Rates of unemployment, and underemployment, are almost always higher for younger people but the recent spike has disproportionately affected younger people. Increased government debt will take many years of fiscal restraint to manage down as a proportion of GDP. Many people, particularly younger people, have drawn down on their superannuation early, which will have downstream consequences for wealth accumulation and standards of living in retirement.

The Green paper identifies existing policy proposals, across each of the domains, which could help improve intergenerational equity. For example, switching from stamp duties to a land tax should encourage more efficient use of housing supply. Additionally, a more concerted effort to limit carbon emissions, in partnership with the global community, will reduce future anthropomorphic climate change.

You can read more about the Index, and details here and the media release here.

Other articles by

Hugh Miller

Other articles by Hugh Miller

More articles

Well, that generative AI thing got real pretty quickly

Six months ago, the world seemed to stop and take notice of generative AI. Hugh Miller sorts through the hype and fears to find clarity.

Read Article

Inequality Green Paper

calls for government policy reform to tackle economic equality gap

In a Green Paper commissioned by Actuaries Institute, Hugh Miller and Laura Dixie, analyse the impact of economic inequality in Australia.

Read Article

Recent articles

Recent articles

More articles

RADAR FY2024 New Zealand Snapshot

Delve into our step-by-step report of the major events, trends and hot topics affecting the general insurance market across Aotearoa

Read Article

Cyber update – protection gap widens for SMEs

Win-Li Toh and Sarah Wood look at why SMEs risk being left behind and offer recommendations in a new Actuaries Institute dialogue paper.

Read Article