New Zealand general insurance 2020 update: news, views and trends

How is the New Zealand general insurance market faring in 2020, and what are its biggest challenges going forward? Using the latest data and our market insight, we shed light on the New Zealand general insurance landscape, covering profitability, COVID-19, regulatory issues and more.

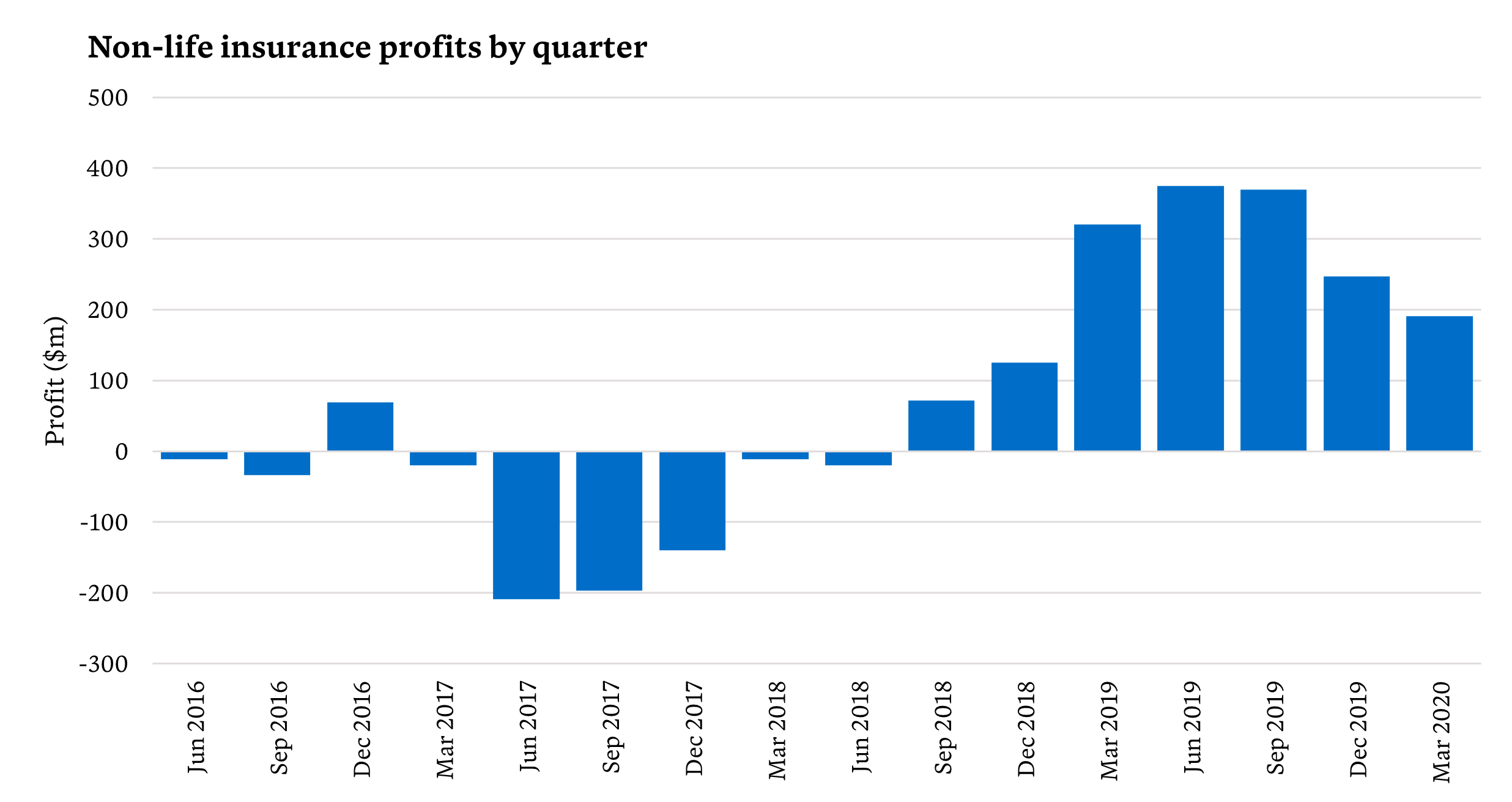

Overall profitability strong, driven by few weather-related events

Despite the uncertainty and global challenges of the ‘new normal’ brought on by the pandemic, general insurers in New Zealand have enjoyed a period of profitability over the past calendar year. This profitability – shown in the figure below – has been heavily influenced by relatively few weather-related large events between July 2018 and October 2019.

Source: RBNZ Quarterly Insurance Financial Performance

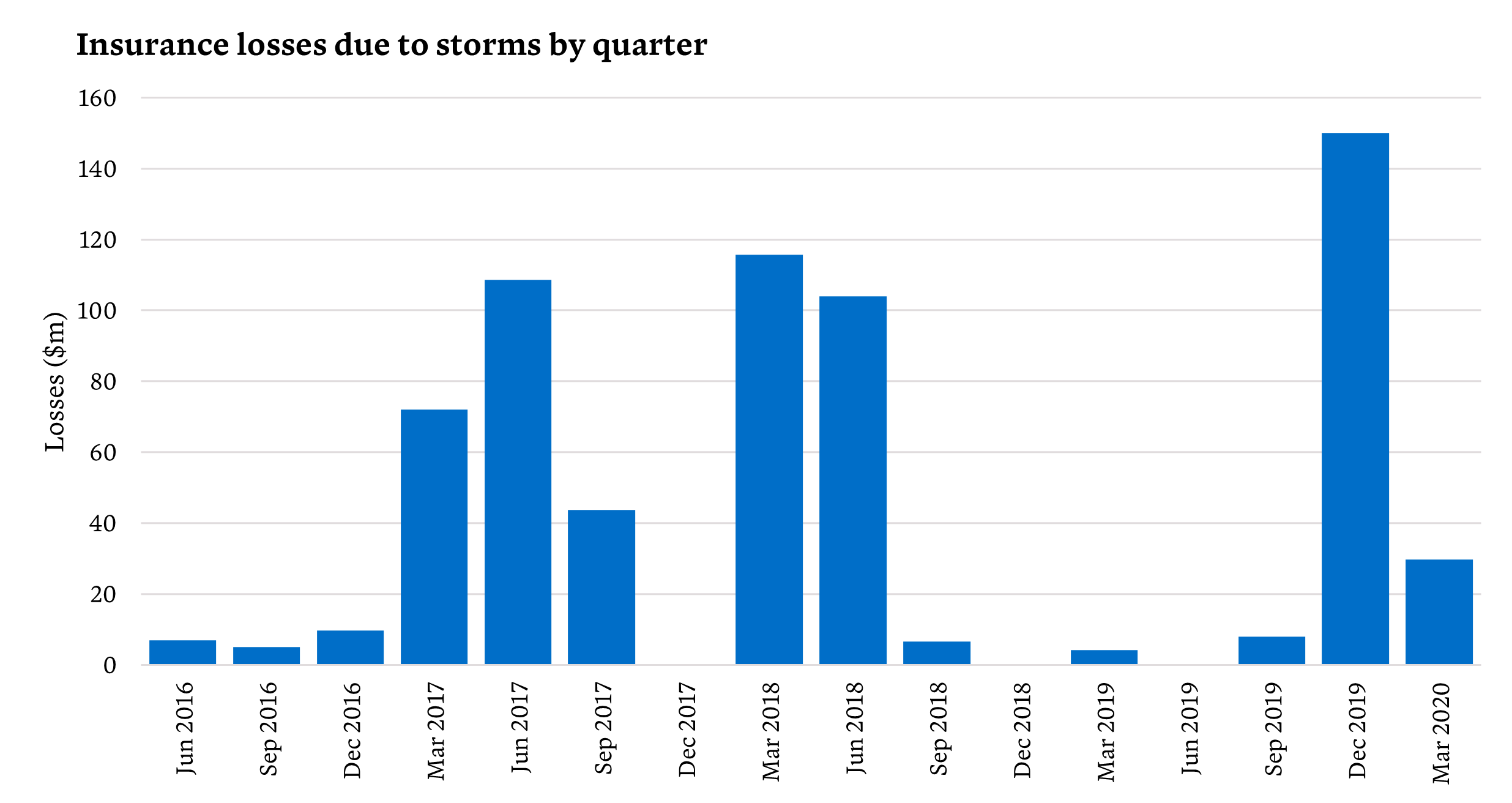

The run of benign weather was broken by the Timaru hailstorm in November 2019, which resulted in total losses of more than $130m 1. In contrast to most New Zealand storm events, where typically property classes are most impacted, more than half of the costs of the Timaru hailstorm have been for motor claims.

Source: ICNZ cost of natural disasters

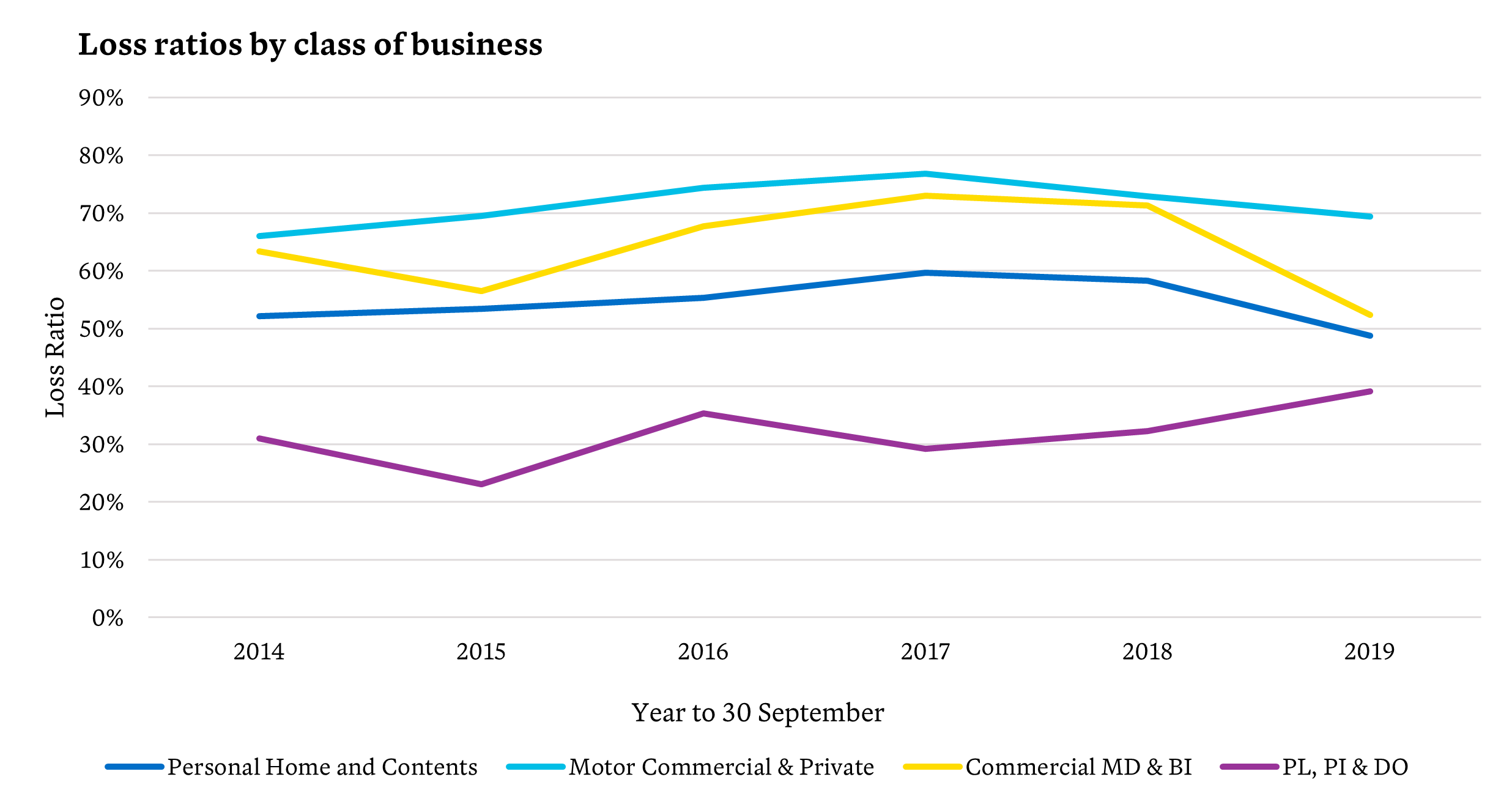

In 2019, property risks for personal lines and commercial lines classes of business in the New Zealand general insurance market had their lowest loss ratios in the past five years2, predominantly due to the lack of large weather events over that period.

Source: ICNZ Market Data

Reinsurance woes mean bigger costs for customers

The favourable claims experience in 2019 resulted in a flattening of premium rates for the personal lines property classes. Annual inflation for home insurance for the year to 30 June 2020 was 0.4%, following three years of increases greater than 5%. Premiums for contents insurance have however continued to increase, although average premiums are generally lower for contents compared to home, due to lower levels of sums insured.

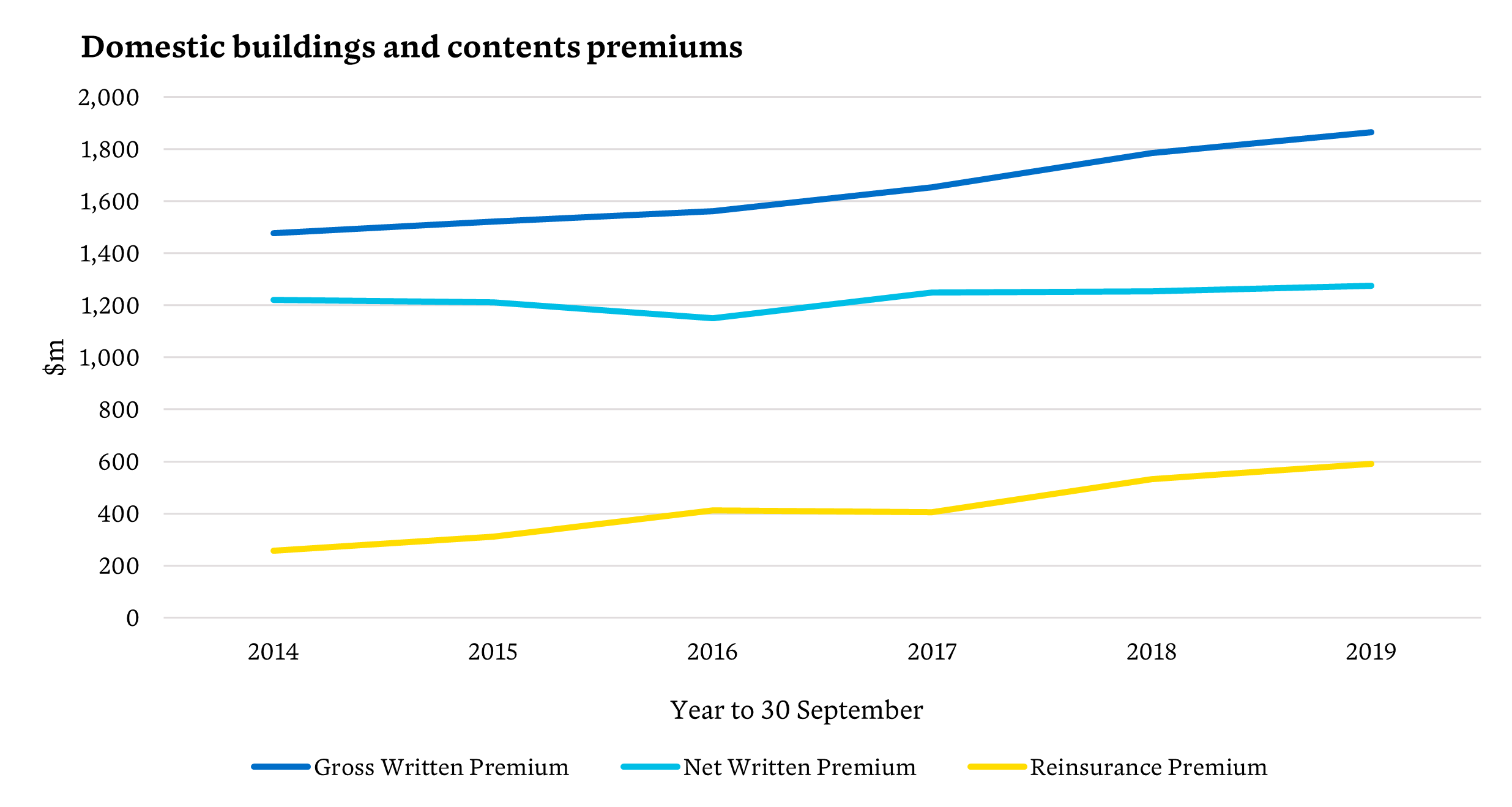

The increase in premiums for home and contents over the past five years has mainly been due to increases in reinsurance costs. The figure below shows gross premiums, which are the costs that customers pay, have increased by an average of 4.8% per annum over the past five years. Net premiums, which are the costs excluding reinsurance, have increased by only 0.9% over the same period.

Source: ICNZ Market Data

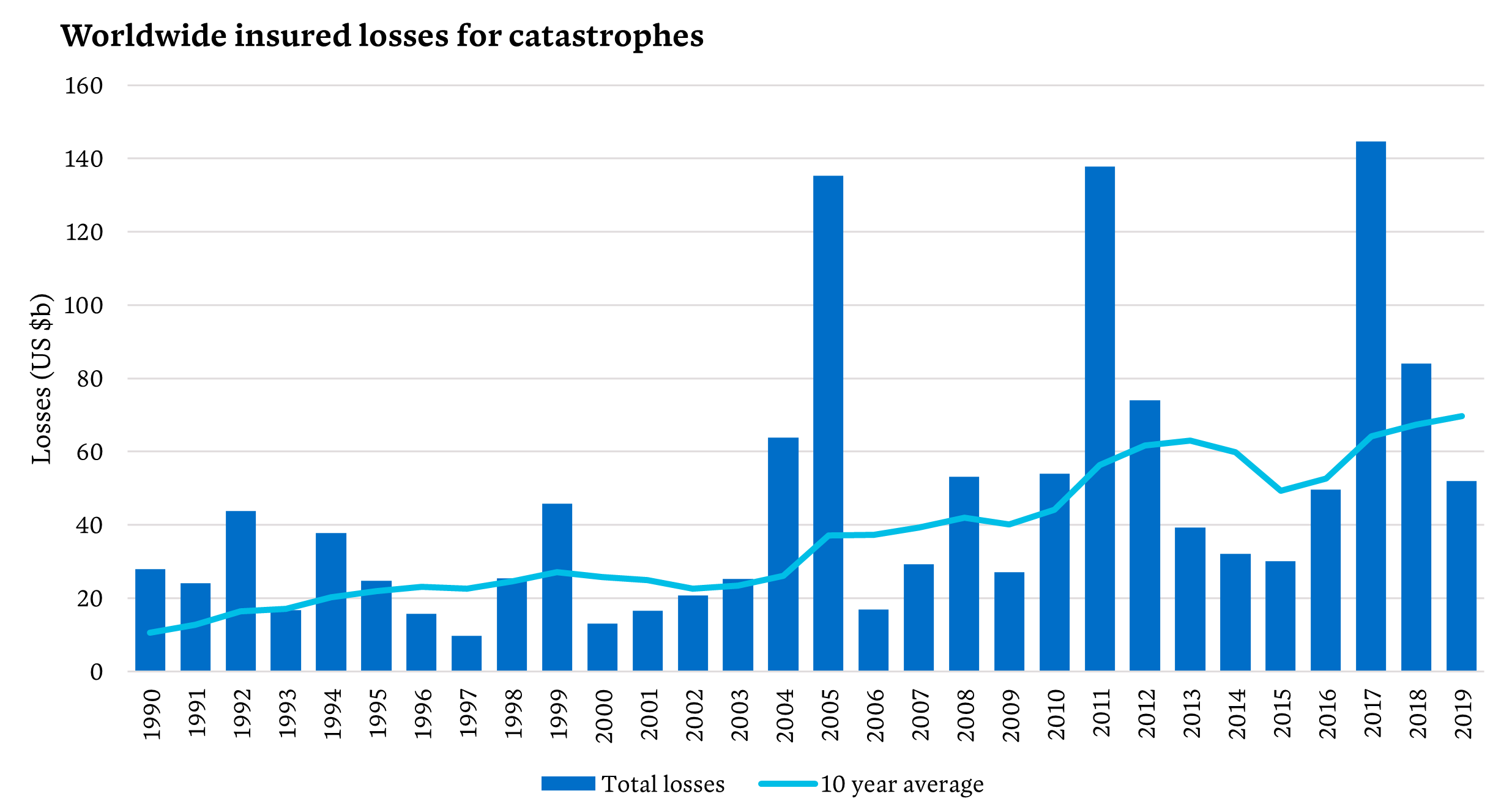

The premiums New Zealand homeowners pay are strongly influenced by the global reinsurance market, and globally, reinsurance losses have been increasing as shown in the figure below. This is due to a combination of increases in the number and severity of natural disasters, and growth in the size of the market, as emerging markets seek reinsurance cover. In Australia, the bushfires of early 2020 are expected to result in the Australian market having its first underwriting loss since 20113.

Source: Swiss Re – Sigma explorer

Global reinsurers hit hard by the pandemic

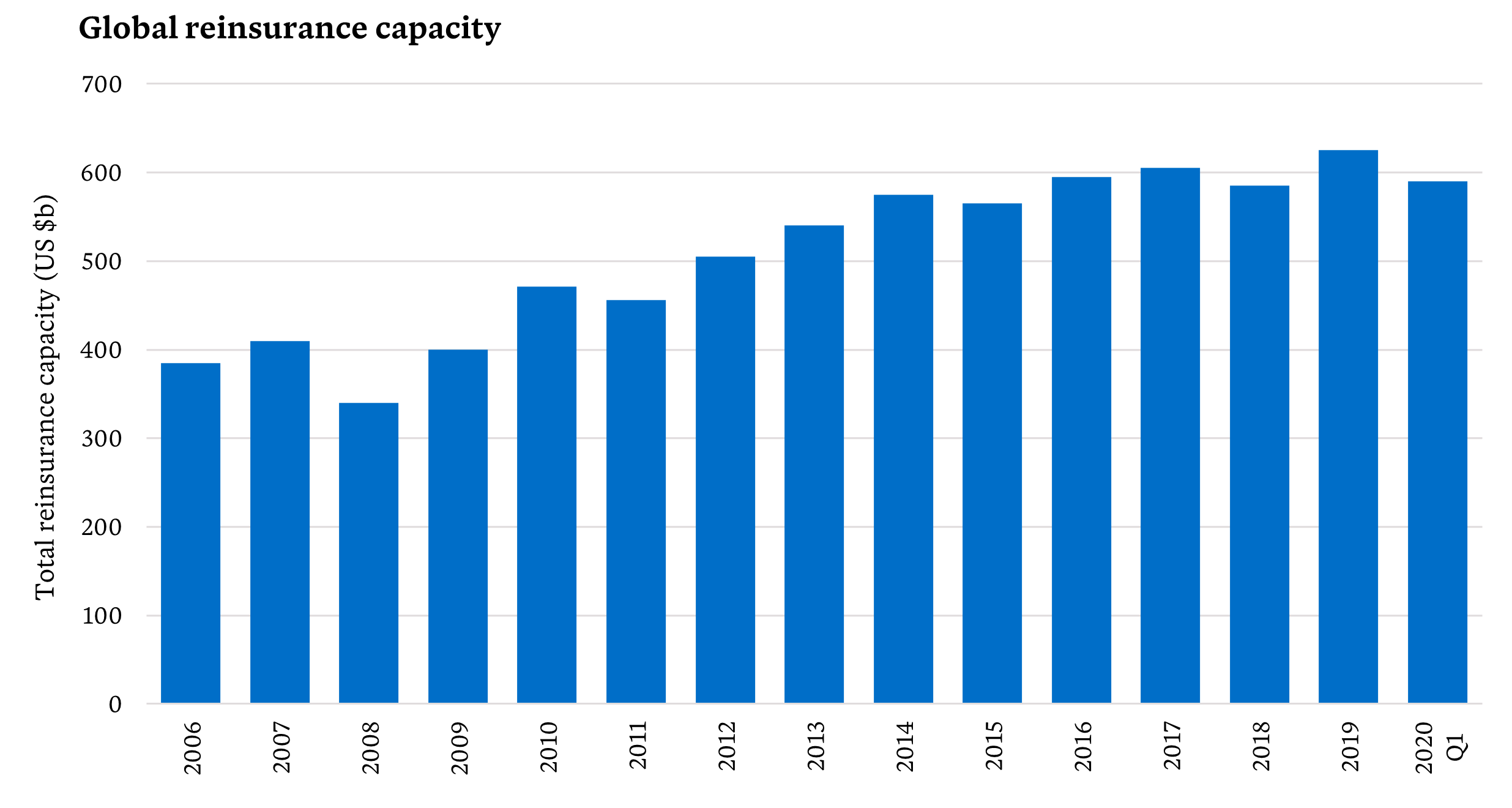

Reinsurance rates are also impacted by the capacity of the global reinsurance market, that is, the amount of capital held by reinsurers that enables them to write reinsurance business. Between 2008 and 2017 reinsurance capacity was increasing. This increase in capacity helped limit the size of reinsurance premium increases.

Reinsurance capacity has been stable since 2017, but early indications are that capacity has reduced in 2020 as the impact of COVID-19 hits global reinsurers in the form of increased losses, weakening balance sheets from reductions in asset values and reduced investment returns from lower interest rates. Swiss Re recently announced it expects reinsurance premiums to increase for the 2021 year4. We expect New Zealand property risks to continue to increase as reinsurance costs increase in the New Zealand general insurance market.

Source: Aon reinsurance market outlook June/July 2020

COVID-19 creates uncertainty for insurers

The COVID-19 pandemic has already had a large impact on the entire New Zealand economy, and the way companies operate. The government-imposed lockdown during April and May meant insurers had to move quickly to remote working. The lockdown also resulted in a reduction in claims for motor insurance. In response, three insurers announced they would be partially refunding premiums to motor customers due to the reduced level of claims during the lockdown5.

In the longer term, the economic impacts of COVID-19 are uncertain. The recent outbreak in Auckland has shown strong border controls will need to remain in place for the foreseeable future. With tourism playing a large part in the New Zealand economy, the longer these restrictions remain in place, the larger the financial impact on the country. The government has so far been proactive in providing support to New Zealand businesses, which has limited the impact on key economic trends, such as unemployment and GDP, but it’s likely more financial pain lies ahead.

Unsurprisingly, COVID-19 has also created uncertainty for New Zealand general insurers. From a claims perspective, the impact will vary between classes of business. For example:

- Traffic volumes tend to reduce during economic downturns

- An increase in the number of people working from home may result in lower numbers of contents claims due to theft

- Economic downturns can often result in an increase in fraudulent claims, which may result in an increase in claim frequency for personal contents and commercial property claims

- Claims under credit insurance policies will also increase as unemployment starts to increase, although this is a relatively small class of business in the New Zealand market.

Low premium volume: a recession reality

The greater impact for New Zealand general insurers will be on claims volumes. Already all major insurers have introduced hardship measures to support customers. Suncorp announced $30m-worth of customer support in its year-end results, although more than half of this relates to the AA Insurance’s motor premium refunds. A recession will see a reduction in premiums as customers in financial hardship look to reduce their costs. This is likely to hit the personal lines and commercial SME classes the hardest.

The other component insurers will need to monitor is how the economic crisis affects asset values and investment returns. Falling interest rates will reduce investment returns, although this will be offset by increasing values for fixed-interest assets. Most New Zealand insurers have quite short-tailed liabilities and so are less affected by investment returns. Even so, it’s still important for insurers to monitor their assets as well as their liabilities and consider how their values will respond in various economic scenarios.

Climate change impacts should still be front of mind

While COVID-19 has been the focus for most insurers over the past six months, it hasn’t reduced the impact of longer-term risks. In late 2019, the annual General Insurance Barometer, Taylor Fry’s joint publication with JP Morgan that surveys Australian general insurers6, identified climate change, with its associated natural perils, and regulation as the two main issues for insurers. The ongoing and far-reaching implications of climate change for insurers remain, despite being overshadowed by COVID-19 over the last six months.

These issues will be no different for New Zealand insurers, as climate change effects will have an unfortunate synergy7. Climate change is expected to increase the frequency of severe meteorological events, such as floods, landslides, strong winds and hail. The higher temperatures and rainfalls arising from climate change will also shorten the lifespan of many buildings. The combination of these effects will result in higher insurance losses in the future. Independent analysis of the effect of climate change on residential property damage estimates insurance losses of between 7% and 8% between 2020 and 2040, and an increase of between 9% and 25% from 2080 to 21008.

Insurers in the New Zealand general insurance market will need to watch out for the emergence of weather-related risks that have not historically been a major concern. The summer drought in Auckland and Northland is potentially a warning sign that risks such as bushfires may increase in New Zealand if we start to see significant changes in regional climates. Over the past four years, we have seen property losses due to summer bushfires in the Port Hills (2017) and Tasman district (2019). While insurance losses for these events have been smaller than other weather-related events, a bushfire in a more densely populated region (such as the Waitakere Ranges) could result in higher losses.

Regulatory developments

On the regulatory front, insurers have plenty of activity to keep a close eye on:

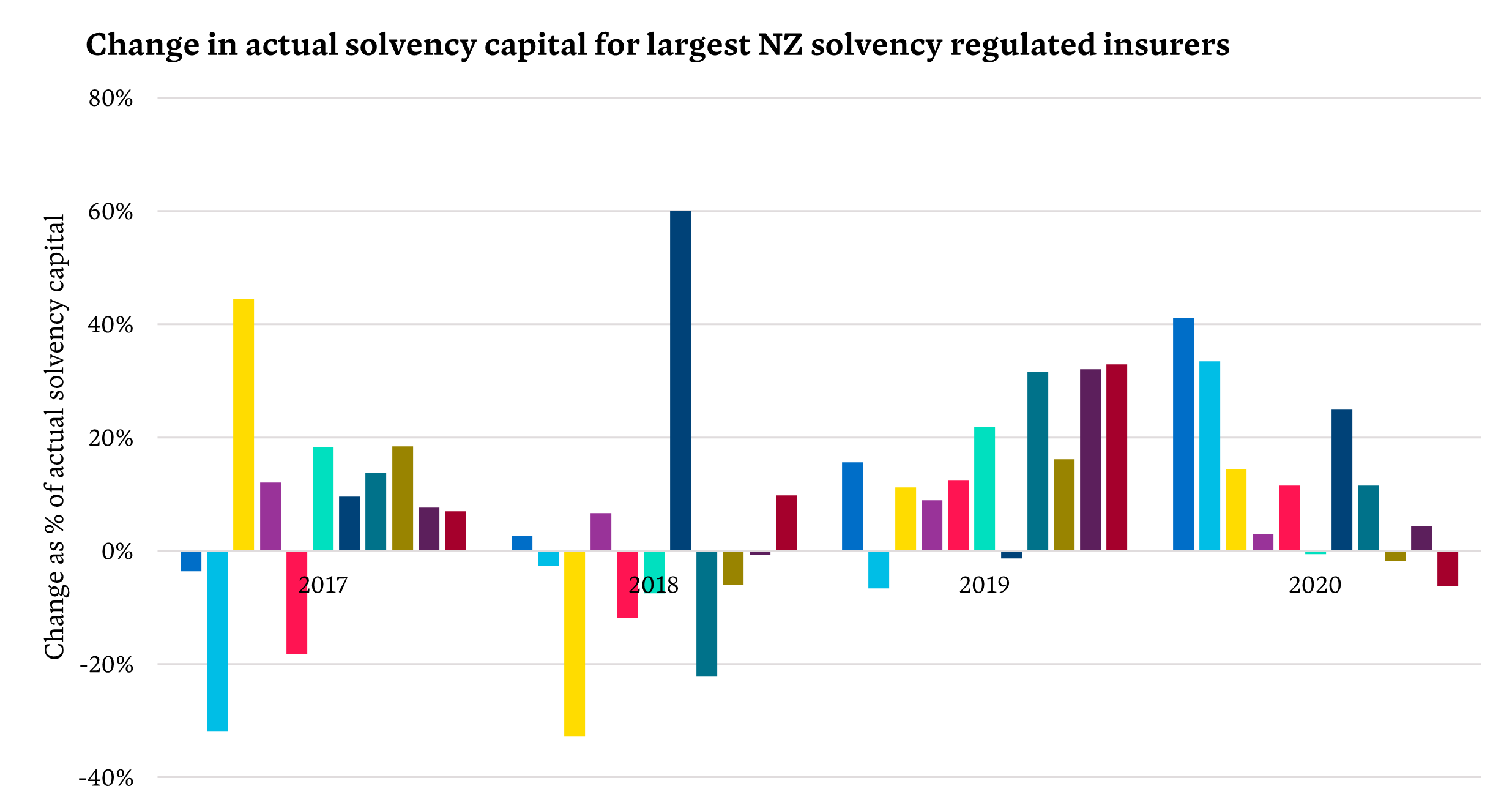

- In July, the RBNZ wrote to insurers outlining its expectations regarding insurers’ capital positions9: given the severe economic uncertainty facing the country, it expects insurers to protect or build their capital positions. In particular, insurers should not be taking any actions that reduce capital, including any reductions due to payments of dividends. This advice makes clear that the RBNZ views the current solvency levels of insurers as being too low, despite an increase in solvency capital over the past two years for all insurers that comply with New Zealand solvency requirements (as opposed to meeting solvency through an overseas parent company). Given the likely reduction in premium volumes resulting from the economic downturn, it’s vital insurers continue to manage their claims and expense costs to maintain capital levels. It also makes sense for insurers to continually monitor their projected capital positions, which will be more uncertain over the next few years due to the unknown future effect of COVID-19.

Source: Insurers websites/accounts from New Zealand Companies Office

- In March, the RBNZ released the findings of its thematic review of the Appointed Actuary regime10. The main theme from the review was a need for the RBNZ to provide clarity and guidance on its expectations of the Appointed Actuary role. The review found that most insurers saw the purpose of the Appointed Actuary was to fulfil statutory requirements. The review makes it clear, however, that the RBNZ’s expectations are much wider than this. It expects the Appointed Actuary to be involved in the insurer’s strategy and be strongly engaged with the insurer’s Board and the RBNZ. Insurers will be watching out for RBNZ consultation on a purpose statement on its expectations and objectives of the Appointed Actuary role.

- The RBNZ has also just announced the continuation of its review of the Insurance (Prudential Supervision) Act 2010, which was suspended in 2018 due to other priorities11. This review will also include a review of the associated Solvency Standards, with a likely introduction of trigger points for regulatory action based on the level of solvency ratios, compared to the current ‘pass or fail’ approach. The announcement was made by RBNZ Deputy Governor Geoff Bascand in a speech to ICNZ12, where Bascand also outlined the RBNZ’s planned response to a world of heightened risk. In particular, the key developments that insurers can expect to see “… will be more intense supervision, particularly in relation to verifying information received from insurers, and concluding enquiries more efficiently”.

- The other area insurers will be keeping a close eye on is the EQC review. A public inquiry into the EQC was completed by Dame Silvia Cartwright in March 2020. One of the recommendations from this review was the current EQC cap on cover be lifted from $150k to $400k. The Government has accepted the intent of this recommendation and asked Treasury to consider it as part of a piece of work it’s undertaking to modernise the Earthquake Commission Act 1993 following the inquiry13. There’s a long way to go on this recommendation, but if it were undertaken by a future Government it would have a substantial impact on home insurance.

Signs of possibility amid the challenge

It’s fair to say 2020 has been a very unusual year and has added additional uncertainty into an industry already dealing with more than its fair share of it. The short-term uncertainty surrounding COVID-19 will be taking insurers’ immediate focus, yet longer-term risks such as climate change and regulatory developments have not diminished. New Zealand insurers have shown in their initial responses to COVID-19 a business agility and willingness to embrace change, promising signs the industry is well placed to continue adapting to an ever-changing future.

Other articles by

Ross Simmonds

Other articles by Ross Simmonds

More articles

RADAR FY2024 New Zealand Snapshot

Delve into our step-by-step report of the major events, trends and hot topics affecting the general insurance market across Aotearoa

Read Article

Elevated premiums and profits – what’s really going on in New Zealand?

A perfect storm may be brewing as Aotearoa community experience and insurer bottom lines collide. Ross Simmonds unpacks the issues

Read Article

Related articles

Related articles

More articles

Cyber update – protection gap widens for SMEs

Win-Li Toh and Sarah Wood look at why SMEs risk being left behind and offer recommendations in a new Actuaries Institute dialogue paper.

Read Article

RADAR FY2024 – Strongest result in more than 10 years, but insurers in regulator sights

RADAR FY2024, Taylor Fry’s annual insurance rundown in a year of solid results alongside a focus on integrity, customers and climate.

Read Article